Empowering Ethiopia’s Growth

Africa Village Microfinance Your Partner for Financial Growth!

At Africa Village Microfinance (AVMF) , we provide accessible loans, high-yield savings, and financial training to farmers, women entrepreneurs, and SMEs across Ethiopia. With 30.8% women borrowers, flexible financing (up to 15 years), and expanding digital services, we’re committed to building inclusive prosperity because when you succeed, Ethiopia thrives.

4.9

20,000+ Client reviews

Choose whats right for you

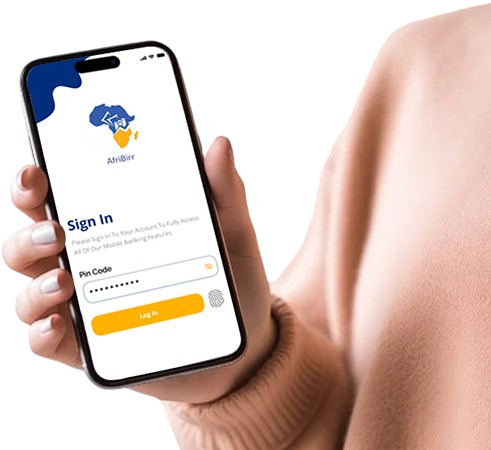

Digital Financial Service

Convenient digital financial services offering mobile banking, transfers, and easy access to your money anytime.

Get StartedPayment & Transfer Services

Fast, secure payment and transfer services to send and receive money with ease across communities.

Get StartedAdvisory, Support, and Insurance Services

Expert advice and microinsurance to protect your finances and guide your journey toward financial stability.

Get StartedLoan and Saving Service

Affordable loans and secure savings designed to empower individuals, businesses, and communities to thrive financially.

Get StartedWho we are

Africa Village Microfinance (AVMF) is a leading microfinance institution dedicated to empowering women, youth, and underserved communities with inclusive financial services and innovative digital solutions. Established in 1998, we provide loans, savings, and financial literacy programs across Ethiopia to foster economic growth and financial inclusion.

Tefera Tesfaye

Chief Executive OfficerYour Journey Begins Here Africa Village Microfinance

At Africa Village Microfinance (AVMF) we believe financial access transforms lives. Whether you're a smallholder farmer, market trader, or growing business, our flexible loans (from 3 months to 15 years), high-interest savings (up to 14%), and free financial training put you in control. With 30.5% women borrowers and a 97% repayment rate, we’re proof that inclusive finance works.

- AVMF’s Core Client Base

- Digital Growth Roadmap

- Expansion Targets (2024-2029)

- Loan Products Snapshot

- Why Partners Choose AVMF

- How AVMF Changes Lives

Banking on Your Success Where Every Birr Counts

At Africa Village Microfinance (AVMF) , we turn your ambitions into reality. Whether you're a small business owner, farmer, or entrepreneur, our low-collateral loans, high-yield savings (up to 14%), and free financial training help you grow, no matter your starting point. With 30.8% women clients and a 97% repayment rate, we don’t just provide money. we build lasting success.

Banking on Women, Building Futures

AVMF empowers Ethiopia's underserved populations through gender-focused loans, high-yield savings, and financial education. With 30.8% women clients and a rapidly expanding network, we're transforming access to finance one community at a time.

Ethiopia's Partner in Prosperity, Sustainable Microfinance

AVMF goes beyond lending by building resilient communities through flexible credit (up to 15-year terms), 8-14% savings returns, and NGO partnerships. Our 97% repayment rate proves trust works better than collateral.

Inclusive Finance, Sustainable Impact Join AVMF’s Mission

AVMF isn’t just a lender we’re a catalyst for rural development. With a 5-year expansion plan and partnerships with AEMFI/NGOs, we’re scaling solutions for Ethiopia’s unbanked. A future award-winner in the making.

Banking on Ethiopia's Potential Together

Africa Village Microfinance bridging financial gaps with group lending models (zero physical collateral) and compulsory savings programs. AVMF isn’t just growing we’re ensuring growth includes women, youth, and rural entrepreneurs.

Fueling Dreams, Building Communities

Loans That Lift Communities

Save Smart, Grow Secure

Banking Made Simple & Local

Your Partner for Financial Growth!

Why Africa Village Microfinance?

Choose Africa Village for inclusive financial solutions tailored to farmers, women entrepreneurs, and SMEs featuring flexible loan terms.

Flexible Loans, 24/7 Protection

Get tailored financing for farmers, women entrepreneurs, and SMEs with no hidden fees and round-the-clock identity security.

Flexible Terms & Secure Banking

We support 30.8% women-led businesses with fair loan sizes, adaptable repayment, and 24/7 fraud protection because your growth deserves safety

Where Proven Impact Meets Future Growth

Women-Centric Financial Inclusion

Digital Transformation (2024/25)

How We Empower Women & Transform Communities

AVMF drives gender equality through financial inclusion 30.8% of our clients are women entrepreneurs gaining access to loans, savings, and business training.

- AVMF's Client Success Formula

- Our Technology Roadmap

- Risk Management Excellence

- Green Finance Initiatives

- Training Programs Offered

- Partnership Opportunities

Start your journey

What our customers say About us

Fatuma S.

Happy ClientAs a single mother, AVMF’s women-focused programs gave me the courage to start my bakery. The group loan support and business mentoring were life-changing.

Almaz T.

Best ReviewHands down, AVMF is the most client-focused microfinance institution I’ve worked with. Their digital services saved me hours of travel, and their staff treated me with respect and patience.

Kebede G.

Happy ClientAVMF's climate financing loan saved my entire harvest during a drought! Their flexible repayment and agri-training helped me double my yields.

Aster K.

Happy ClientAVMF's loan services transformed my small business—I went from struggling to thriving in just one year. Their low-interest rates and flexible repayment terms made all the difference.

30.8%+

Women Customers

25+

Years in banking

20+

Branches

Building Prosperity, One Community at a Time

Africa Village Microfinance S.C. empowers individuals and businesses across Ethiopia with inclusive financial solutions—from flexible loans and high-yield savings to financial training and climate-smart financing. With 30.8% women clients, 17+ branches, and a commitment to rural growth, we don’t just provide money—we build opportunities for farmers, entrepreneurs, and families to thrive.